tax identity theft definition

The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. A tax identity theft scam or W-2 scam can happen if say a cybercriminal hacked into an executives email account and sent communication from that alias targeting your HR or.

What Is Identity Theft Identity Theft Definition Avast

Tax-related identity theft occurs when someone uses your stolen Social Security Number to file a tax return claiming a fraudulent refund.

. Tax-related identity theft occurs when someone uses your stolen Social Security number to file a tax return claiming a fraudulent refund. The Department of Revenue is. Ad See how supercomputing is improving products now and in the future.

The IRS outlines its definition of tax identity theft as occurring when someone uses your stolen personal information. In situations where a taxpayer makes an allegation of identity theft or when the IRS initially suspects that identity theft may have occurred IRS functions will apply an identity. If your wallet or.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Tax identity theft is when a criminal steals your information specifically your Social. After the IRS processes your identity theft affidavit the IRS will place an identity.

Celebrate Exascale Day by joining live webinar sessions from industry experts. More from HR Block. IRS Form 14039 is an identity theft affidavit that you send the IRS if your personal information has been stolen.

Identity theft is the crime of obtaining the personal or financial information of another person for the sole purpose of assuming that persons name or identity to make. If you choose IdentityTheftgov will submit the IRS Identity Theft Affidavit to the IRS. There are a lot of ways ones identity can be stolen.

H and R block Skip. Tax-related identity theft occurs when someone uses your stolen Social Security Number to file a tax return claiming a fraudulent refund. Ad Dentists Are At High Risk Of Being Embezzled.

More from HR Block. If your wallet or. You might think youre in the clear because you.

More from HR Block. IdentityTheftgov will create your. During tax season tax identity theft is one of the most common forms of identity theft.

If this happens go to IdentityTheftgov and report it. More from HR Block. Tax-related identity theft occurs when someone uses your stolen Social Security number to file a tax return claiming a fraudulent refund.

Tax-related identity theft occurs when someone uses your stolen personal information including your Social Security number. Learn what the IRS identity theft indicator means. Identity theft occurs when someone fraudulently obtains or uses your personal information such as your name social security number or credit card number.

Identity theft can occur when criminals steal your personal information including your name birthday address phone number social security number andor financial. Due to federally declared disaster in 2017 andor 2018 the. Using all 3 will keep your identity and data safer.

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. More Than 70 Will Suffer A Loss During Their Careers. Read the IRS definition and get more insight from the experts at HR Block.

Identity theft occurs when someone uses another persons personal identifying information like their name identifying number or credit card number without their permission to commit. File taxes online Simple steps easy tools. Tax identity theft happens when someone uses your personal information to file a tax return claiming the fraudulent returns are yours.

In situations where a taxpayer makes an allegation of identity theft or when the IRS initially suspects that identity theft may have occurred IRS functions will apply an identity.

How To Prevent Identity Theft Id Theft Statistics For 2022 Norton

A Guide To Identity Theft Statistics For 2022 Mcafee Blog

Fraud South Florida Has More Than Twice As Much Identity Theft As Other Metro Areas South Florida Business Journal

Five Things You Need To Know About Identity Theft And Tax Returns

How To Prevent Identity Theft Id Theft Statistics For 2022 Norton

Identity Theft Central Internal Revenue Service

What You Need To Know About Tax Scams Security News

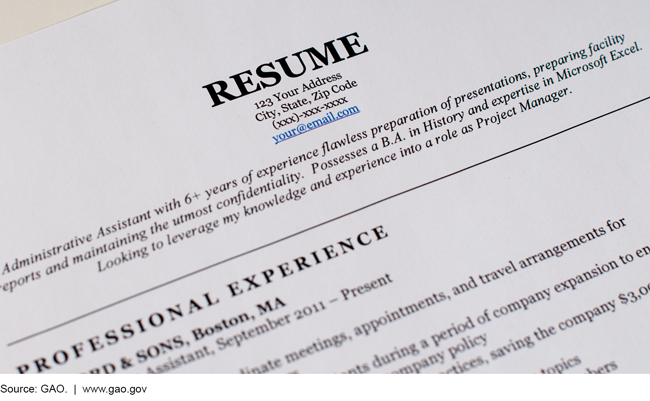

Employment Related Identity Fraud Improved Collaboration And Other Actions Would Help Irs And Ssa Address Risks U S Gao

What Is Tax Identity Theft And How Do You Prevent It Debt Com

Stroke Onward Identity Theft Book

How I Became A Poster Child For Tax Identity Fraud Duke Today

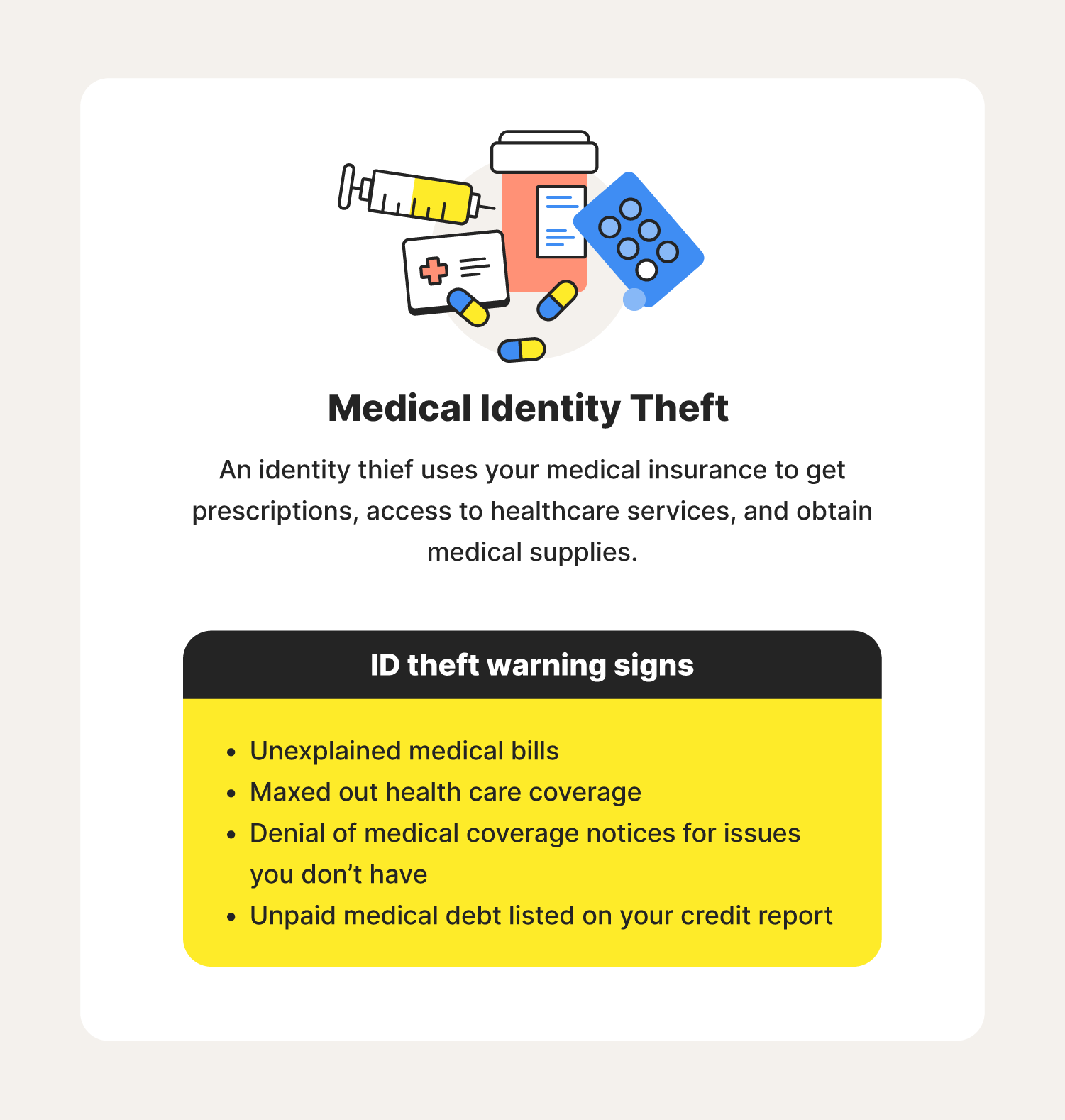

Infographic Protecting Yourself From Identity Theft

Identity Theft What It Is How It Happens The Best Protection

How To Prevent Identity Theft Id Theft Statistics For 2022 Norton

Id Theft Protection Services Provided After A Data Breach Are Not Taxable Tax Pro Center Intuit

/tax-indentification-number-tin.asp_final-7524207031a4442187c30846d85f1ee2.png)

Tax Identification Number Tin Definition Types And How To Get One